Reality of housing shortage exposed in July

Sometimes you just have to shake your head at the reports we read about the Greater Vancouver housing market. Such as quotes from regional politicians about how much they care about making homes more affordable while continuing to restrict supply. The latest knee-slapper is the supposedly surprising news that Greater Vancouver homeowners are far more likely to own multiple homes than anywhere else in the country, despite Vancouver being among the world’s most expensive cities for housing.

The reality, of course, is that Vancouver’s consistently elevated prices are the very reason some people want to own as many homes as possible.

What should be surprising is that more Vancouver homeowners don’t do the same thing, especially today with both mortgage lending rates and housing supply at incredibly low levels.

In Greater Vancouver the average value of a home—a composite of detached houses, condo apartments and townhouses—has increased by $351,000 in the past five years. Since July 2020, the average detached house price in Greater Vancouver has risen by $312,000, in a region where the average annual household income is $100,600.

In the past six months, the typical Greater Vancouver home has increased in value by 13%, while the annual interest rate on mortgage is less than 3%. Homeowners can do the math. Leveraging the existing equity in a home to buy another property makes sound economic sense. Many see it as only proven way to protect a family from the ravages of inflation. It shouldn’t be surprising.

In July, however, Greater Vancouver buyers of all types faced a dilemma: the number of new listings fell to the lowest level of any month this year, down 26.4% from a year earlier and 25.2% below the level in June 2021. Fraser Valley listings hit a 40-year low. It is normal in July for both sellers and buyers to take a summer breather, especially this year following record-breaking sale and price increases. July sales were down for the fourth straight month in a market distracted by great summer weather and the lifting of most COVID-19 restrictions. The concern, though, is whether there will be enough listings to meet the inevitable uptick in demand as the summer wanes.

The gap between listings and sales is tightening. In July only 4,377 new listings of all types of homes were added to the market, but sales totaled 3,372 transactions. Total active listings across Greater Vancouver are 12.2% lower than the 10-year average for July, while sales are 13% higher.

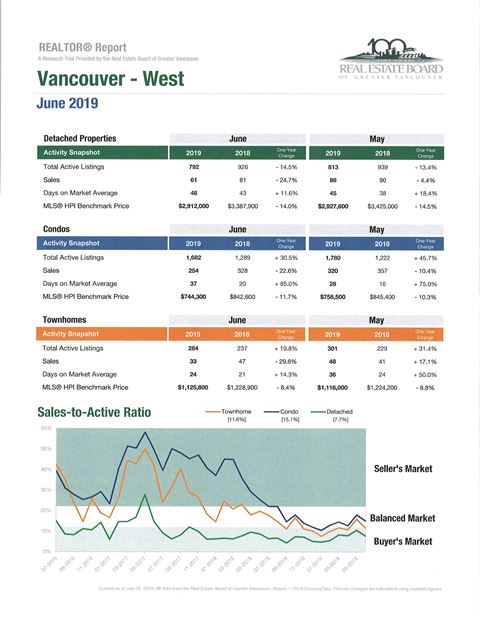

The result is that the July sales-to-active-listing ratio was 33.3% and this tightened to 37.3% for condominium apartments and 47.7% for townhouses, the most in-demand housing sector across the Lower Mainland. The benchmark townhouse price is now $949,900, up 16% – nearly $152,000 from the same month last year, a compelling reason for investors to buy another townhouse.

The problem is finding one. Aside from the lack of listings, there are only 1,149 new townhouses under construction in all of Greater Vancouver. In the City of Vancouver just 58 new townhouses have started this year. The townhouse shortage is acute in many markets where sales outstripped supply in July, including South Delta, Maple Ridge, Port Coquitlam, Port Moody and Whistler-Pemberton. In Port Moody, for instance, there were only 17 new listings for townhouses but 47 sales in the month, exhausting the total inventory of active listings. Many other markets, such as Coquitlam where July townhouse sales accounted for 95% of listings, are close to near-zero inventory.

Balance in our real estate market will never be achieved without some serious consideration on increasing the supply long term.

Townhouse market snapshot for July 2021

Townhouse active listings, Greater Vancouver: 689

Townhouse active listings, Surrey: 1,156

Lowest price townhouse, Maple Ridge: $668,000

Highest townhouse sales-to-listing ratio: Port Moody at 276%.

Total townhouses under construction, City of Vancouver: 95

Total townhouses under construction, City of Surrey: 1,139

Greater Vancouver: We suspect the seasonal sales slowdown in July was aggravated by buyers waiting for new listings that never arrived. Still, with 3,375 transactions, this was the sixth-highest July for sales in history, combined with the lowest number of new listings for a July in 11 years.

The July benchmark price for a Greater Vancouver detached house was $1,801,000, compared to $736,900 for a condo apartment. This helps explain why condominium apartment sales posted the largest year-over-year increase in July, rising 19%, while detached house sales were down 6% and townhouse sales, largely due to a lack of listings, were unchanged from July 2020. Condominiums accounted for 49% of all sales in July, but both new and active listings for condo apartments were down 21% from a year earlier. This compares with a 7% decline in total detached house listings and a 34% fewer listings for townhouses when compared with a year earlier.

As we roll into August and the traditionally high sales seen in September, the shortage of homes for sale, particularly in the strata sector, will be the headline news. Active listings have been falling month-over-month since May. If you are a homeowner and have considered listing, now may be the best time this year to come to a market that is packed with eager and frustrated buyers.

Fraser Valley: The inventory of active listings in the Fraser Valley fell to the lowest level in July in 40 years, after total active listings fell to 4,901, down 33% from July 2020 and 10.5% lower than in June 2021. Total sales also slowed, down 11% from June 2021 to 2,006, but were still 15% above the 10-year average for the month. A bright spot is the large inventory of townhouses on the Fraser Valley market, when compared with Greater Vancouver.

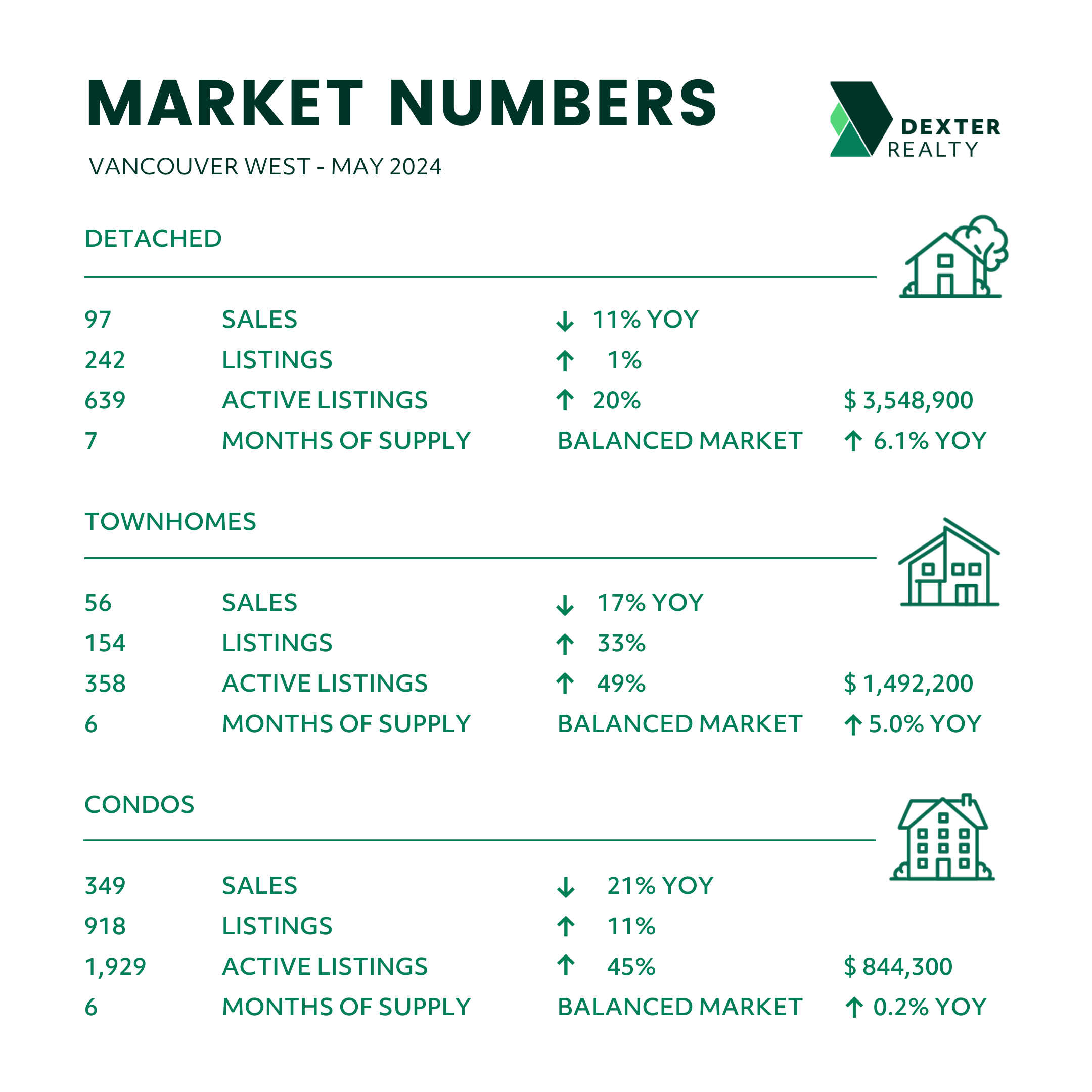

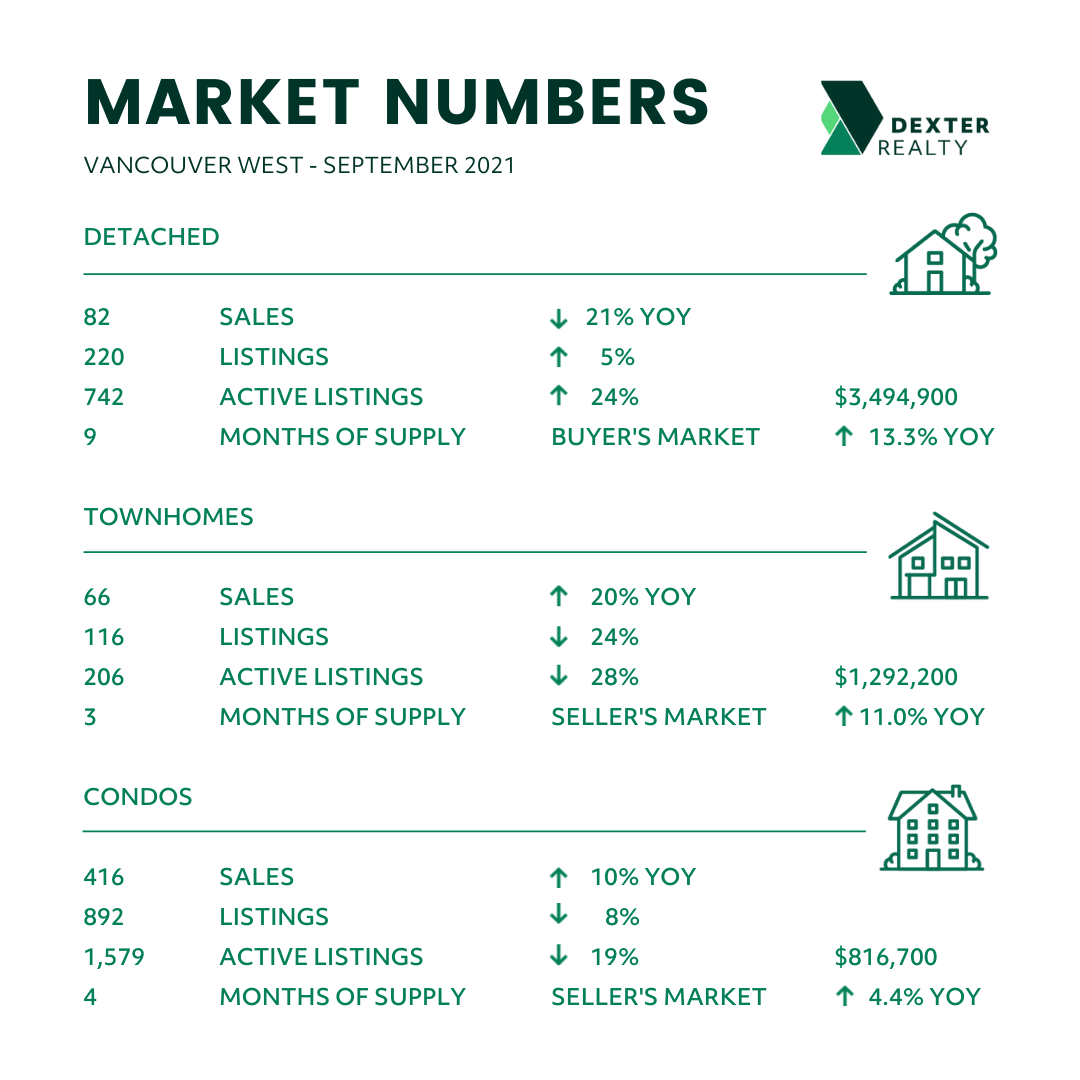

Vancouver Westside: The benchmark price of a detached house on Vancouver’s Westside in July reached $3,466,200, virtually unchanged ( up 0.2%) from a month earlier but 17.6% higher than in July 2020. With 93 sales in July, detached sales on the Westside this year total 766 houses, up from 444 in the first seven months of 2020. Condo apartment sales dominated July on the Westside with 419 transactions, at a benchmark price of $829,300. Townhouse sales dipped to 57 in July, down from 74 in June, as a lack of new listings – just 87 – kept some buyers sidelined. In all, the Westside sales to listing ratio in July was at 62%, a strong seller’s environment in Greater Vancouver’s most expensive market.

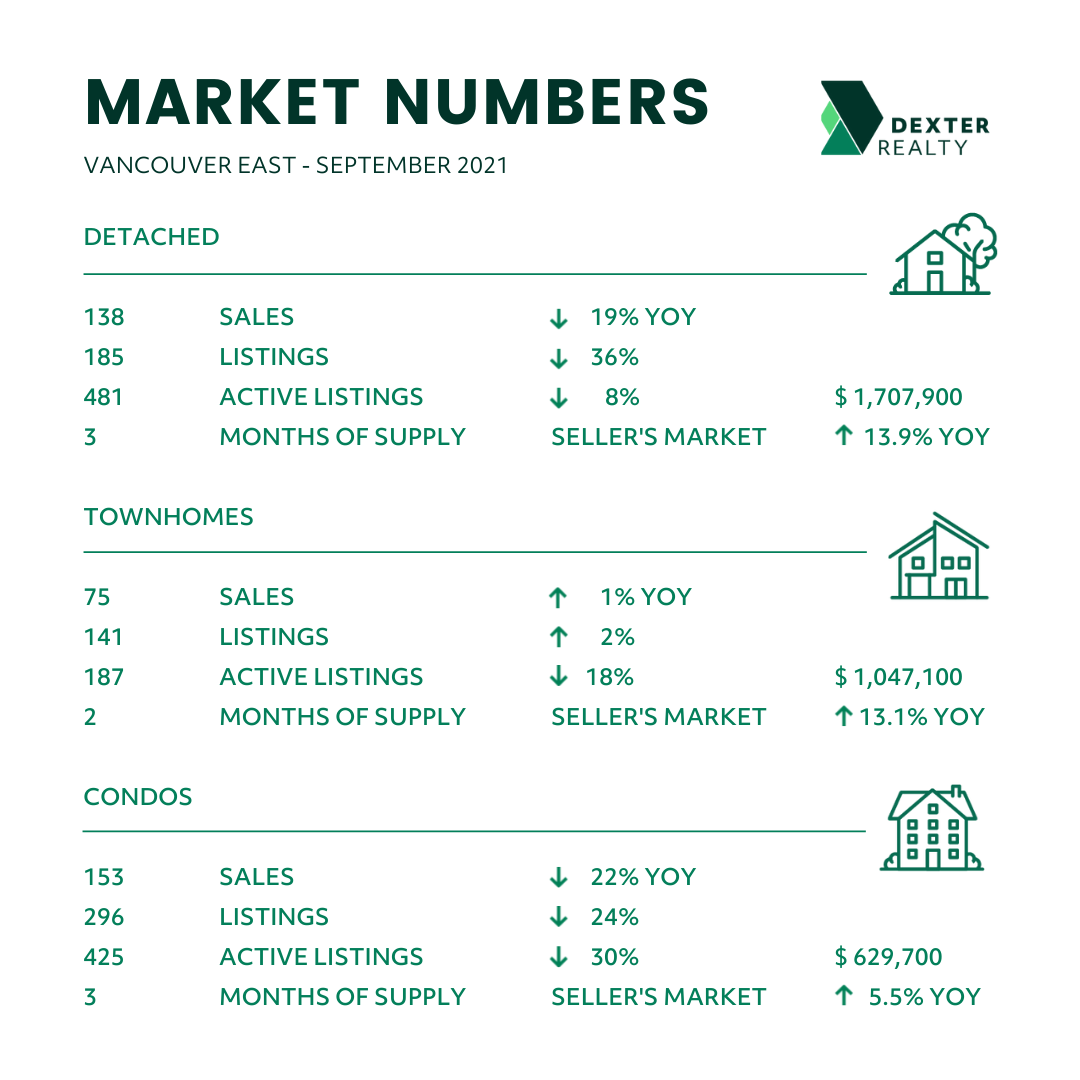

Vancouver East Side: As we have been noted for some months, Vancouver’s East Side story is one of rising sales of detached houses, easily eclipsing the more expensive Westside. In July, 144 detached houses sold in the East at a benchmark price of $1,688,500, a price nearly 50% lower than the 93 houses sold west of Quebec Street. Investors are very active right across the East Side, especially in the condominium market, spurred on by the visual start of the Broadway Corridor SkyTrain extension and settling down of price increases, which has seen condo prices hold steady for three months at $632,300. Townhouse sales, at 57, were the same on both the East Side and Westside in July, butt the East Side price was about $210,000 lower at a benchmark of $1,165,000. The supply of total East Side residential listings is steady at three months and the sales- to-listings ratio in July is a high 74%, signalling a continued seller’s market.

North Vancouver: North Vancouver District leaders were voted in two years ago with pledge to slow residential development. In July, after a year-long review, the District now says it wants to increase the supply, but to prioritize “rental, social, and supportive housing projects.” Bottom line is little will be done to address the acute shortage of market housing. In June, latest monthly data available, only 17 new homes had started in all of North Vancouver and there were no townhouse starts at all. The lack of supply has led to the second-highest suburban home prices in Metro Vancouver, at a composite benchmark of $1,226,000. July total housing sales across North Vancouver, at 252, were down 22% from June, one of the biggest drops in the region and off 6% from July 2020. Active listings plunged to 512 in July, down from 620 in June. The month’s supply of total residential listings is a tight two-months, and a sales-to-new-listings ratio of 84% keeps North Vancouver among the strongest seller’s market in the province.

West Vancouver: Perhaps the most prestigious housing enclave in Canada, with a July benchmark house price of $3,121,800, West Vancouver detached house sales dipped to 54 transactions in July, down from 60 a month earlier but unchanged compared to July 2020. A total of 21 condos sold in July at a benchmark of $995,000. Active listings were at 572 in June, compared to 618 at the end of June. New listings were down 25% from June 202 and 20% below July 2020. West Vancouver is a relatively balanced on high-priced perch, with about a seven-month supply and a sales-to-listing ratio in July at 53%, up from 42% a month earlier.

Richmond: Total housing sales and new listings both dropped sharply in July, down, respectively, 11% and 15% from a month earlier. The big drop was seen in detached house transactions, which fell to 94, down 61% from June, even as the benchmark house price held steady at $1,910,000. Condo sales were among the highest in the Metro region, with 236 apartments selling at median price of $620,000. Richmond had the highest number of new listings for townhouses, with 124, but 79% of these sold in July, pushing the benchmark townhouse price up a further 1% from a month earlier to $932,600. Richmond’s supply of total residential listings is up to a four-month’s supply, if the current sales trend continues.

Burnaby East: The smallest of the three Burnaby markets profiled, Burnaby East posted 46 total housing sales in July, down 6% from June but 32.4% higher than in July 2020. Active listings, though, dropped to just 83, down from 104 in June 2021. Benchmark detached house prices, at $1,431,000, and condo apartment prices, at $728,000, were virtually unchanged from a month earlier. The overall sales-to-listing ratio is 89%, indicating a strong seller’s market.

Burnaby North: Tunnels are being bored through Burnaby Mountain this summer for an oil pipeline that will link Burnaby’s tidewater to the Alberta oil fields. The action has apparently helped fuel demand for detached houses, as prices have increased 18.2% in the past year, the biggest increase in Burnaby, to $1,746,800. A large supply of new condo apartments completed in the Brentwood area likely affected benchmark condo prices, which were virtually unchanged in July from a month earlier, at $716,600. The overall sales-to-listing ratio of 73%, however, points to higher home prices in this seller’s market.

Burnaby South: A total of 202 residential properties sold in July, down 7% from a month earlier, but new listings dropped month-over-month by 24%, setting up a very tight 73% sales-to-listing ratio. As of the of July there were only 585 total active listings, enough to last just three months at the current sales pace. The composite benchmark detached house price in July was $1,774,500, highest in Burnaby, and up 1.1% from a month earlier.

New Westminster: Stability characterized the ‘Royal City ’in July as housing sales and prices were a near mirror image of June. Detached house sales, at 26, were identical, townhouse sales were up by one in July to 20, and apartment sales increased by 5 transactions to 113 in July.

The composite home price in July was also nearly unchanged, rising 0.9% to $721,300. The big difference was in new listings, which dropped to 20% month over month, with total active listings down 26% to 347 in July. With an overall sales-to-listing ratio of 86%, up from 61% in June, New Westminster remained a very active seller’s market this July.

Coquitlam: There are 3,060 new homes under construction right now in Coquitlam, including 231 townhouses and 2,652 apartments, most of which are condominiums. This is encouraging because active listings for resale homes are falling, dropping to 645 in July, down from 745 a month earlier. New listings fell 20% month-over-month. Sales also slowed, down 11% from June to a total of 292 in July, but benchmark prices stayed virtually unchanged, with detached house values at $1,505,400; townhouse prices up 0.5% to $847,500; and condo apartment prices rock steady from a month earlier at $588,900. The detached house sales success ratio is 105%, however, with townhouses seeing an 89% sales-to-listing ratio and 76% of condo listings selling in July, the stage is set for price appreciation if more listings don’t arrive soon.

Port Moody: The townhouse shortage is very apparent in Port Moody, where the sales-to-listing ratio in July was a startling 276%. There were just 17 new listings for townhouses in the month but there were 47 sales, meaning the inventory of total listings is disappearing quickly. I suspect there have been multiple offers as the benchmark townhouse price was up a further 1.2% in July from a month earlier, at $761,000. Sales of detached houses were also strong, with a 91% sales-to-listing ratio and benchmark prices unchanged up 0.7% from a month earlier, at $1.863,800, highest in the Tri-Cities.

Port Coquitlam: First-time buyers and investors are likely taking a close look at Port Coquitlam. The most affordable housing market in the Tri-Cities, PoCo is close enough to SkyTrain to make it accessible for commuters. The benchmark condo price, at $528,900 in July, was unchanged from June and is about $210,000 lower than the Greater Vancouver average. Total home sales in July were down 26% from June and 13% lower than in July 2020, at 103 transactions. This is a sleeper market that is awakening, reflected in the 94% sales-to-listing ratio in July.

Pitt Meadows: Perhaps it was the summer distraction in the lake-endowed community, but Pitt Meadows saw both sellers and buyers taking a break in July. New listings dropped 40% from a month earlier and sales fell 11% to just 39 transactions. The benchmark price for a detached house dipped just 0.8% month-to-month, to $1,193,800, with townhouse prices and condo apartment prices also virtually unchanged at $753,200 and $543,500, respectively. As of June there were only 33 new townhouses and no new condo apartments under construction in Pitt Meadows. A startling 106% sales-to-listing ratio in July is a signal that Pitt Meadow prices may rise if supply falls any further.

Maple Ridge: There are 157 townhouses under construction in Maple Ridge, including the 44 that started this year. Many of these new units are likely selling out, however, as the sales-to-listing ratio for resale townhouses topped 100% in July. Townhouse benchmark prices were $688,800 in July and condo apartments at $425,900, both among the lowest in Greater Vancouver. Detached house prices, at $1,129,900, were unchanged from June after rocketing up 34% year-over-year.

Ladner: The supply pressure is being felt by buyers in Ladner, where currently only 8 townhomes and 11 apartments are available for sale. There are only about 68 new townhouses under construction in all of Delta, but few are in Ladner. Active listings fell to 77 in July, down nearly 50% from a month earlier, and new listings are down 40% from a month earlier. With a sales-to-listing ratio of 122% in July, frustrated buyers bid condo prices up 2.6% in July from a month earlier, to $583,700. So far townhouse prices are holding steady at $754,200 after surging 11% over the past six months, and the detached house price is up 15.2% in the same period to a July benchmark of $1,263,400.

Tsawwassen: Don’t expect to see lot of new market residential in Tsawwassen. Even a modest 48-unit rental building is currently facing opposition. A shame, because demand remains high in this sunny community. While total sales were down 17% in July from June, new listings fell 35% and there were only 168 homes of all kind on the market at the of July, compared to 295 at the same time last year. With a sales-to-listing ratio hitting 89%, Tsawwassen’s composite home price has increased 12.3% over the past six months to $1,145,700 as of July.

Surrey: B.C.’s second-largest city is a safety valve for those who want to buy a townhouse but have difficulty finding one in Greater Vancouver. There are 1,139 new townhouses under construction in Surrey, compared to 1,149 in all of Greater Vancouver. In July, there were also 1,156 active listings for resale townhouses, com. Surrey’s average townhouse price in July was $710,200, up 1.1% from a month earlier.

Kevin Skipworth, Partner/Broker and Chief Economist at Dexter Realty